Mubarak Bello, a Webflow Developer and No-Code expert, had a harrowing experience receiving an international payment from his Australian client. Following an agreement to pay 40% of the total project cost upfront, Mubarak sent his Wise account details. The client paid, which ought to reflect within a few days.

Days turned into weeks, weeks turned into three weeks, and payment was returned to the client. Mubarak reached out to Wise, but they told him the payment was returned due to restrictions by the Nigerian government. It's months now, and Mubarak still hasn’t received his payment even though the project is complete.

Mubarak is just one of the many freelancers experiencing numerous challenges with receiving payments from clients. In this article, we'll talk about the common issues freelancers face with payments and how CanWork's universal payment system can help.

Let’s take a closer look at some of the common issues freelancers face with traditional payment systems that make them far from perfect.

Many freelancers typically invoice clients for services. The Getting Paid in the Independent Economy report found that 72% of freelancers have invoices that clients haven't paid for, while 70% consistently get late payments from clients.

Most payment systems for freelancers will only remind clients about late invoices without having processes for claiming overdue and unpaid invoices.

Many traditional payment systems have long wait times to process payments. This leaves freelancers needing help to meet their financial obligations. Milo Cruz is a chief marketing officer at Freelance Writing Jobs from the Philippines. He goes through strict customs and documentation checks required by the local banking system. As a result, he experiences delays in processing payments that impact his cash flow.

Freelancers have to deal with deductions and transaction fees from payments ranging from 5% to 20%, depending on the platform. Additional processing and transaction charges are between 3% and 6% for withdrawals. Abderahemane Nejjam, a freelance content writer from Morocco, pays a 7% withdrawal fee for direct withdrawals to his bank account.

Deborah Sabinus is a freelance finance/fintech writer living in Nigeria. She once lost a client due to the miscellaneous charges the payment platform kept charging her client’s credit card.

While there seem to be many payment systems for freelancers, they have different restrictions and limitations. Freelancers in developing countries like Nigeria have to use alternative payment methods as there are restrictions with popular payment options like PayPal. Even these alternative methods aren't foolproof and can fail at any point, like Mubarak experienced with Wise.

For freelancers outside the US, it’s hard to get international payments into local bank accounts. Mike Humphrey, writer and entrepreneur currently living in Japan, says the internal payment systems don’t work well with international transactions. As a result, he has to use online banking solutions that also have complications, like withdrawal limits and currency conversions.

Working with clients outside your home country is one of the perks of freelancing. However, the downside is a currency conversion loss that reduces freelancer earnings when converting from one currency to another. Joshua, a freelance B2B writer from Singapore, says, “High currency conversion loss, processing fees, and delays in getting payments are top pain points for his freelance earnings.”

There's an abundance of payment systems for freelancers. However, some locations have restrictions on which payment systems freelancers can use to receive payments from clients.

Deborah Sabinus says, “Most 'global' payment platforms are designed with only American and European users in mind. So people outside these regions generally have a not-so-great user experience, especially with verification and withdrawal options.”

A universal payment system for freelancers like CanWork’s Quick Escrow solves many payment problems. These benefits can help freelancers all over the world succeed and thrive. Let’s jump in.

Many freelancers have trouble receiving payments due to a lack of accessible payment systems. A universal payment system for freelancers solves this by centralising client payments, which relieves the burden of numerous payment constraints and procedures.

Most payment processors and apps freelancers use to receive payments have fixed transaction and withdrawal rates. A universal payment system for freelancers boosts profit margins and financial security by offering low fees on monies received and various transactions.

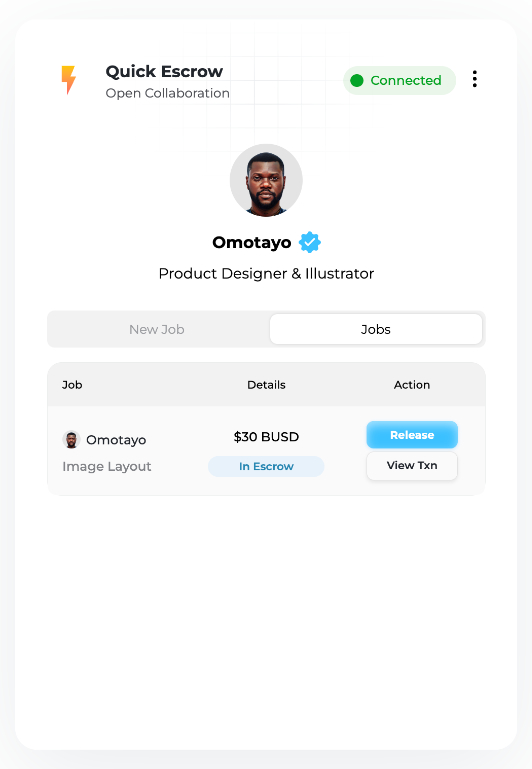

Online fraud and cyber attacks are valid fears for freelancers and clients alike. A universal payment system like Quick Escrow provides a secure payment system that caters to all parties using smart contract technology and fraud-prevention measures.

Freelancers are afraid to work without getting paid upfront, like this freelancer who's out $7,000 from his client. Clients are also afraid to pay for a project unless they are confident the freelancer will complete the work. A universal payment system protects freelancers and their clients. It provides payment security for freelancers and processes to protect clients’ interests.

Disputes about payments aren't uncommon for freelancers. These can arise due to price disagreements, changes in work scope, and work quality, amongst others. While many freelance platforms offer arbitration when such issues occur, they're largely ruled in favour of clients.

A universal payment system for freelancers acknowledges this and makes it easy for both parties to work out payment issues. A defined process that's fair and transparent for everyone involved makes this possible.

30% of freelancers regularly process their payments in digital currencies because they're easy, quick, and hassle-free. They're also free from rigorous verifications and intermediaries that are part of international payments.

A universal payment system for freelancers that uses digital currencies crosses out problems with international payments. It also gets rid of restrictions for freelancers who can’t use traditional payment methods.

With a universal payment system like CanWork’s Quick Escrow, there's no need for intermediaries associated with traditional freelancer payment methods. It gives freelancers direct access to a reliable system that allows them to receive payments from clients worldwide without any challenges whatsoever.

CanWork is changing how you get paid as a freelancer with Quick Escrow, our universal payment system. Let's tell you all you need to know about it.

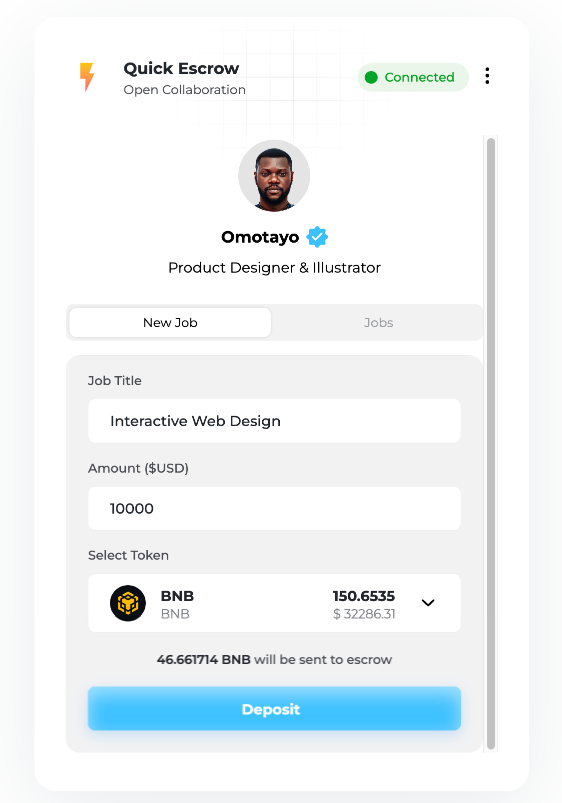

As the name implies, Quick Escrow provides you with a quick, secure, and borderless payment system to receive payments from clients. The goal is to get rid of the issues known with traditional payment systems and make it easy for clients to pay you.

Quick Escrow employs smart-contract technology to secure transactions and protect everyone’s interests. It also leverages payment in digital currencies by allowing clients to pay for services in BNB and other popular BNB Chain assets.

You need to create a profile on CanWork and get verified to use Quick Escrow. Your clients however don't need to create an account before paying you for your services.

Let’s look at the features of Quick Escrow that make it the perfect universal payment system for freelancers.

CanWork’s Quick Escrow will be available soon for verified Freelancers. You will need to do the following.

Now that you know what Quick Escrow is all about, say goodbye to payment delays, high transaction fees, and location restrictions limiting your freelance earnings. With faster payment processing and increased security, you can earn more and take control of your finances.

Sign up on CanWork now to use Quick Escrow, the universal payment system for freelancers.

Available August 2023